For first-time car owners, navigating the world of auto insurance can be overwhelming. With numerous options available, it’s crucial to find a provider that offers affordable, flexible, and user-friendly solutions tailored to meet your unique needs. Enter Direct Auto Insurance—a company dedicated to simplifying the insurance process, especially for new drivers. This article aims to explore the key benefits of choosing Direct Auto Insurance, highlighting why it’s an excellent choice for first-time car owners.

Toc

- 0.1. Affordable Coverage Tailored to You

- 0.2. Dedicated Customer Service

- 0.3. Flexibility in Payments

- 0.4. User-Friendly Online Platform

- 0.5. Additional Benefits for New Car Owners

- 1. Types of Coverage of Direct Auto Insurance

- 2. Related articles 01:

- 2.1. Liability Coverage

- 2.2. Collision Coverage

- 2.3. Comprehensive Coverage

- 2.4. Uninsured/Underinsured Motorist Coverage

- 2.5. Medical Payments Coverage

- 2.6. Personal Injury Protection (PIP)

- 2.7. Specialized Services of Direct Auto Insurance

- 2.8. Customizable Payment Plans

- 2.9. SR-22 Filing Services

- 2.10. Discount Programs

- 2.11. Mobile App for Easy Access

- 3. Related articles 02:

- 4. Testimonials and Casestudies

- 5. Conclusion

Direct Auto Insurance Key Features

Direct Auto Insurance offers a range of features that make it stand out from other providers. These include:

- Affordable Rates: For first-time car owners, managing expenses can be challenging. That’s why Direct Auto Insurance offers competitive rates that cater to your budget, without compromising on the coverage you need. With flexible payment options and discounts for safe driving, students, and military personnel, Direct Auto Insurance ensures you get the best value for your money.

- Customizable Coverage: Every driver has unique insurance needs depending on their vehicle type, driving habits, and personal circumstances. Direct Auto Insurance understands this and allows customers to personalize their coverage plans accordingly. Whether you need basic liability coverage or additional protection for your new car, Direct Auto Insurance gives you the freedom to choose what works best for you.

- User-Friendly Services: As a first-time car owner, understanding insurance policies can be daunting. That’s why Direct Auto Insurance provides user-friendly services such as online quotes, easy-to-follow policy documents, and a 24/7 customer service helpline. With these convenient features, you can easily manage your insurance needs without any hassle.

Affordable Coverage Tailored to You

One of the standout features of Direct Auto Insurance is its affordable coverage options, specifically designed to accommodate the budgets of first-time car owners. The company understands that purchasing a car is a significant investment, and managing insurance costs can be equally daunting. Direct Auto Insurance offers various coverage levels, ensuring you only pay for what you need. Whether you’re looking for basic liability coverage or comprehensive plans that offer wider protection, there’s an option that fits your financial situation without compromising on quality. Additionally, the company offers discounts for safe driving, making it easier for new drivers to save money on their insurance premiums.

Dedicated Customer Service

When it comes to choosing an insurance provider, excellent customer service is crucial. Direct Auto Insurance prides itself on its knowledgeable, friendly, and efficient customer support team. They

Flexibility in Payments

Insurance costs can often seem like a heavy burden, especially for new car owners. Direct Auto Insurance addresses this concern with flexible payment plans that make managing insurance expenses easier. You can choose from multiple payment methods and schedules, allowing you to spread out your costs over time. This flexibility ensures you can maintain your budget while still securing the essential coverage you require.

User-Friendly Online Platform

In our digital age, convenience is key. Direct Auto Insurance provides a user-friendly online platform that simplifies policy management and bill payments. This system allows you to:

- View and update your policy details

- Make payments securely

- Access important documents anytime, anywhere

No more waiting in line or dealing with cumbersome paperwork—everything you need is just a click away. This ease of use is particularly beneficial for first-time car owners who may already be overwhelmed by the numerous responsibilities that come with owning a vehicle.

Additional Benefits for New Car Owners

In addition to its key features, Direct Auto Insurance offers specific benefits that cater to the needs of new car owners. These include:

- Gap Coverage: If your new car is totaled or stolen within the first year of ownership, Direct Auto Insurance’s gap coverage will bridge the gap between what you owe on your car loan and its current market value. This helps protect your finances and ensure you’re not left with significant debt in case of an unfortunate event.

- Roadside Assistance: As a new driver, experiencing a breakdown or getting locked out of your car can be stressful. Direct Auto Insurance offers 24/7 roadside assistance to help you in these situations, giving you peace of mind on the road.

- Accident Forgiveness: Accidents happen, especially for new drivers who are still getting used to the roads. With Direct Auto Insurance’s accident forgiveness program, your first at-fault accident won’t lead to an increase in your insurance premium, allowing you to maintain affordable coverage.

Types of Coverage of Direct Auto Insurance

1. https://suvwars.com/archive/613/

2. https://suvwars.com/archive/630/

3. https://suvwars.com/archive/940/

Direct Auto Insurance offers various types of coverage options designed to meet the diverse needs of car owners. Whether you’re a new driver or someone with years of experience on the road, there are several key coverage types you can expect:

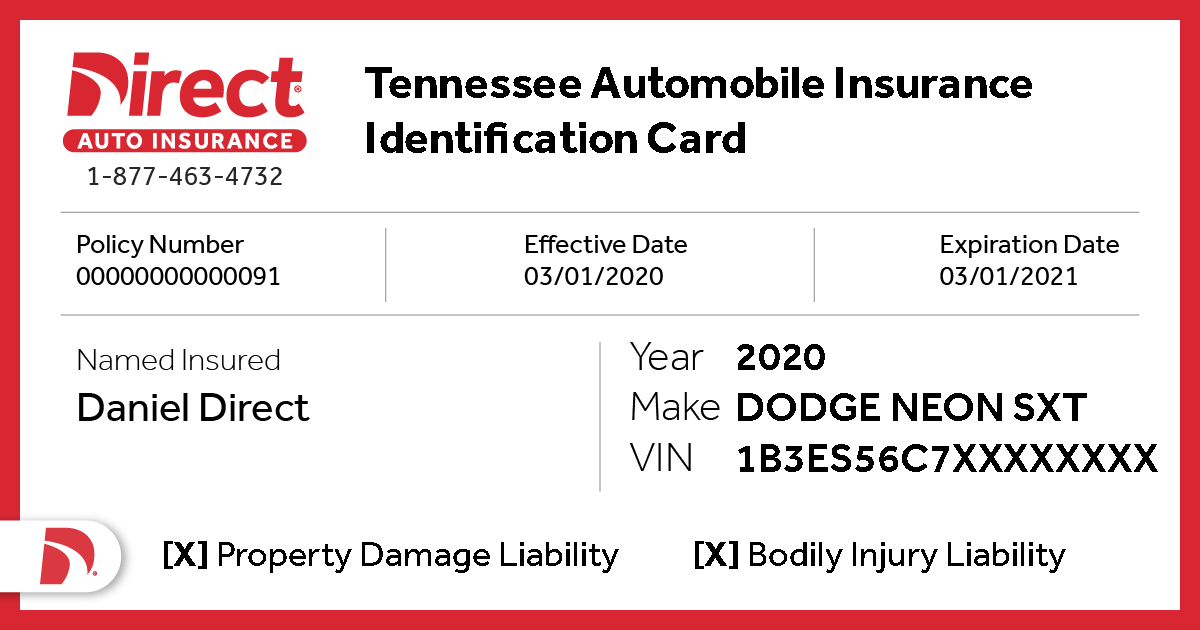

Liability Coverage

Liability coverage is essential for all car owners as it protects you from financial losses in case of an accident where you are at fault. This type of coverage includes both bodily injury and property damage liability, ensuring that any medical expenses or repair costs incurred by the other party are covered. Direct Auto Insurance provides robust liability coverage options that conform to state requirements, giving you peace of mind while driving.

Collision Coverage

Collision coverage is particularly beneficial for new car owners as it covers the cost of repairing or replacing your vehicle after an accident, regardless of who is at fault. This type of coverage can be a financial lifesaver, especially for those who have financed their car. By choosing Direct Auto Insurance’s collision coverage, you can drive with confidence, knowing that you’re protected against unforeseen repair costs.

Comprehensive Coverage

Comprehensive coverage goes beyond collisions, protecting your vehicle from other types of damage such as theft, vandalism, natural disasters, and falling objects. For new car owners, comprehensive coverage offers an added layer of security, ensuring that your investment is protected from a wide range of risks. Direct Auto Insurance provides comprehensive plans that can be tailored to your needs, ensuring you get the best possible coverage.

Uninsured/Underinsured Motorist Coverage

Despite legal requirements, some drivers remain uninsured or underinsured. If you’re involved in an accident with such a driver, uninsured/underinsured motorist coverage by Direct Auto Insurance can help cover your medical expenses and damage to your vehicle. This type of coverage is especially important for new car owners who might not have the financial means to cover significant out-of-pocket expenses.

Medical Payments Coverage

Medical payments coverage, also known as MedPay, helps cover medical expenses for you and your passengers if you’re injured in an accident, regardless of who is at fault. This coverage is particularly beneficial for new car owners who may not yet have health insurance plans that cover accident-related injuries. With Direct Auto Insurance, you can ensure that medical costs are taken care of swiftly and efficiently.

Personal Injury Protection (PIP)

Personal Injury Protection (PIP) is similar to medical payments coverage but offers broader benefits. PIP can cover medical expenses, lost wages, and even rehabilitation costs after an accident. For new car owners, PIP provides comprehensive financial support, helping you recover without the stress of medical bills. Direct Auto Insurance’s PIP plans are designed to offer extensive protection so you can focus on your recovery.

Specialized Services of Direct Auto Insurance

Direct Auto Insurance goes beyond traditional coverage options by offering specialized services tailored to the unique needs of its customers. These services aim to provide additional value and support, ensuring that you are well-protected and that your insurance experience is as smooth as possible.

Customizable Payment Plans

Understanding that every customer has different financial circumstances, Direct Auto Insurance offers customizable payment plans. Whether you prefer to pay monthly, quarterly, or annually, there are flexible options available to suit your budget. This level of customization helps alleviate the financial burden of maintaining car insurance, making it accessible for everyone.

SR-22 Filing Services

For drivers who have had their licenses suspended or revoked, obtaining an SR-22 certificate can be a cumbersome process. Direct Auto Insurance simplifies this by offering SR-22 filing services directly through their platform. This service ensures compliance with state regulations and helps you get back on the road legally and quickly.

Discount Programs

Direct Auto Insurance provides various discount programs to help reduce premiums. These discounts can be based on factors such as safe driving records, bundling multiple policies, or even completing defensive driving courses. New car owners can particularly benefit from these discounts, which can make high-quality insurance more affordable.

Mobile App for Easy Access

In today’s digital age, having access to your insurance details on the go is crucial. Direct Auto Insurance offers a mobile app that allows customers to manage their policies, make payments, and access important documents directly from their smartphones. This convenience is particularly advantageous for new car owners who are adapting to the responsibilities of vehicle ownership.

1. https://suvwars.com/archive/944/

2. https://suvwars.com/archive/939/

3. https://suvwars.com/archive/608/

Testimonials and Casestudies

To further showcase the benefits of Direct Auto Insurance, here are some real-life testimonials and case studies from satisfied customers:

Mary J. – First-time Car Owner

“I was nervous about getting my first car because I knew I needed insurance, but didn’t know where to start. Direct Auto Insurance made the process so easy and affordable for me. They explained all the coverage options in a way that I could understand and helped me choose the best plan for my budget. Now I feel confident driving knowing that I’m protected.”

John R. – Victim of Hit-and-Run Accident

“Last month, I was involved in a hit-and-run accident that left my car badly damaged. Thankfully, I had comprehensive coverage with Direct Auto Insurance, which covered the cost of repairs. I was relieved knowing that my investment was protected and didn’t have to worry about paying out-of-pocket for the damages.”

Sarah M. – Single Parent with Limited Budget

“As a single parent, budgeting is always a concern for me. When it came time to insure my new car, I was worried about the costs. But Direct Auto Insurance offered customizable payment plans and discounts that made it much more affordable for me. I’m grateful for their flexibility and understanding of my financial situation.”

Final Thoughts

As a new car owner, it’s essential to have the right insurance coverage to protect yourself and your investment. Direct Auto Insurance offers comprehensive plans, specialized services, and affordable options that cater to the unique needs of its customers. With their support, you can confidently hit the road knowing that you’re well-protected. Don’t wait any longer – get in touch with Direct Auto Insurance today and secure your peace of mind on the road.

Conclusion

Choosing the right auto insurance is essential for first-time car owners, and Direct Auto Insurance offers a range of benefits that make it an excellent choice. From affordable and customizable coverage options to flexible payment plans, a user-friendly online platform, specialized services, and round-the-clock customer support, Direct Auto Insurance is committed to meeting the unique needs of new drivers.

Customer Testimonial

“The online platform is so easy to use. I can manage my policy and make payments from anywhere, making my life as a new car owner less stressful.” – Sam, Satisfied Customer

Don’t let the complexities of auto insurance deter you from enjoying the freedom of owning your first car. Consider Direct Auto Insurance for a seamless, stress-free experience that keeps you protected on the road. Sign up today and discover how easy it can be to get the coverage you need.