Pay-per-mile auto insurance is a type of coverage that bases premiums on the number of miles driven by the policyholder. This can be a cost-effective option for individuals who do not drive frequently or have a short commute. By tracking mileage through a device installed in the vehicle or a mobile app, insurance companies can accurately calculate premiums based on actual usage. This can result in savings for low-mileage drivers compared to traditional auto insurance policies.

Toc

- 1. Understanding the Technology Behind Pay-Per-Mile Auto Insurance

- 2. Tips for Saving Money with Pay-Per-Mile Auto Insurance

- 3. Related articles 01:

- 4. Comparing Pay-Per-Mile Auto Insurance to Traditional Coverage

- 5. Related articles 02:

- 6. How Pay-Per-Mile Auto Insurance Rates are Calculated

- 7. Benefits of Pay-Per-Mile Auto Insurance:

- 8. Conclusion

Understanding the Technology Behind Pay-Per-Mile Auto Insurance

Pay-per-mile auto insurance is a relatively new concept in the insurance industry that is gaining popularity among drivers who are looking for a more personalized and cost-effective way to insure their vehicles. This innovative insurance model uses technology to track the number of miles driven by a policyholder, allowing insurance companies to calculate premiums based on actual usage rather than estimates or averages.

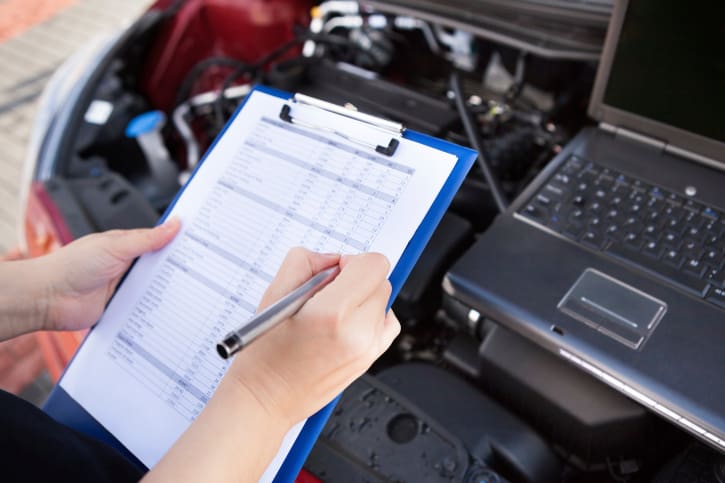

The technology behind pay-per-mile auto insurance typically involves the use of a telematics device that is installed in the insured vehicle. This device collects data on the distance traveled, as well as other factors such as driving behavior, time of day, and location. This data is then transmitted to the insurance company, which uses it to determine the policyholder’s premium.

One of the key benefits of pay-per-mile auto insurance is that it allows drivers to pay for insurance based on their actual driving habits. This means that low-mileage drivers who use their vehicles infrequently can potentially save money on their premiums, as they are not being charged for miles they are not driving. On the other hand, high-mileage drivers may end up paying more for their insurance, but they can still benefit from the transparency and fairness of the pay-per-mile model.

Another advantage of pay-per-mile auto insurance is that it encourages safer driving habits. Because the telematics device tracks driving behavior, policyholders are incentivized to drive more carefully in order to potentially lower their premiums. This can lead to fewer accidents and claims, which benefits both the insurance company and the policyholder.

In addition to promoting safer driving, pay-per-mile auto insurance can also help reduce carbon emissions and promote environmental sustainability. By encouraging drivers to use their vehicles less frequently, this insurance model can contribute to a reduction in greenhouse gas emissions and air pollution. This aligns with the growing trend towards eco-friendly practices and sustainable living.

While pay-per-mile auto insurance offers many benefits, it is important for drivers to understand how the technology works and what information is being collected. The telematics device used in pay-per-mile insurance policies typically collects data on driving habits, including speed, acceleration, braking, and cornering. This data is used to assess risk and calculate premiums, but it is important for policyholders to be aware of the information being collected and how it is being used.

Overall, pay-per-mile auto insurance is a promising innovation in the insurance industry that offers a more personalized and cost-effective alternative to traditional insurance models. By using technology to track actual usage and driving habits, this insurance model can provide drivers with greater transparency, fairness, and control over their insurance premiums. As more drivers become aware of the benefits of pay-per-mile insurance, it is likely to become an increasingly popular option for those looking to save money, drive safely, and reduce their environmental impact.

Tips for Saving Money with Pay-Per-Mile Auto Insurance

Pay-per-mile auto insurance is a relatively new concept in the insurance industry that is gaining popularity among drivers looking to save money on their car insurance premiums. This type of insurance is based on the number of miles you drive, with the idea being that the less you drive, the less you pay. In this article, we will explore how pay-per-mile auto insurance works and provide some tips for saving money with this type of coverage.

One of the key components of pay-per-mile auto insurance is a device that is installed in your car to track the number of miles you drive. This device is typically a small telematics device that plugs into your car’s onboard diagnostics port. The device collects data on your driving habits, including the number of miles you drive, your speed, and how often you drive. This data is then used to calculate your insurance premium, with drivers who drive fewer miles paying less for their coverage.

1. https://suvwars.com/archive/944/

2. https://suvwars.com/archive/940/

3. https://suvwars.com/archive/635/

One of the main benefits of pay-per-mile auto insurance is that it can help you save money on your car insurance premiums. If you are someone who drives infrequently or only uses your car for short trips, pay-per-mile insurance can be a cost-effective option. By only paying for the miles you drive, you can potentially save hundreds of dollars a year on your insurance premiums.

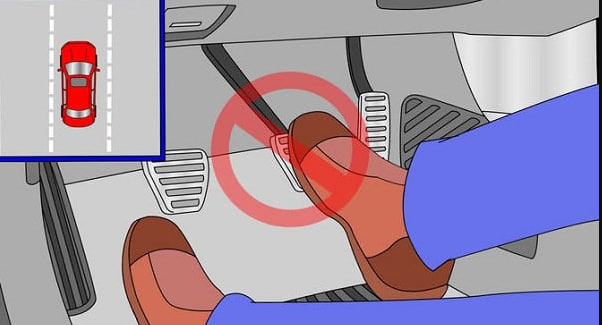

Another benefit of pay-per-mile auto insurance is that it can encourage safer driving habits. Because your insurance premium is based on how you drive, there is an incentive to drive more cautiously and avoid risky behaviors such as speeding or hard braking. This can not only help you save money on your insurance premiums but also make the roads safer for everyone.

If you are considering switching to pay-per-mile auto insurance, there are a few tips to keep in mind to help you save even more money. First, be sure to accurately estimate the number of miles you drive each year. If you underestimate your mileage, you could end up paying more for your insurance than if you had chosen a traditional policy. On the other hand, if you overestimate your mileage, you may be paying for more coverage than you need.

Another tip for saving money with pay-per-mile auto insurance is to take advantage of any discounts that may be available. Some insurance companies offer discounts for safe driving habits, such as avoiding accidents or speeding tickets. By driving safely and responsibly, you can potentially lower your insurance premium even further.

Finally, be sure to shop around and compare quotes from different insurance companies before choosing a pay-per-mile policy. Rates can vary significantly between providers, so it pays to do your research and find the best deal for your individual needs.

In conclusion, pay-per-mile auto insurance is a cost-effective option for drivers who do not drive frequently. By tracking the number of miles you drive and adjusting your insurance premium accordingly, pay-per-mile insurance can help you save money on your car insurance premiums. By following these tips, you can maximize your savings and enjoy the benefits of this innovative type of coverage.

Comparing Pay-Per-Mile Auto Insurance to Traditional Coverage

Pay-per-mile auto insurance is a relatively new concept in the insurance industry that is gaining popularity among drivers looking for a more flexible and cost-effective way to insure their vehicles. Unlike traditional auto insurance policies that charge a flat rate based on factors such as age, driving record, and location, pay-per-mile insurance bases premiums on the number of miles driven. This can be a game-changer for drivers who don’t use their vehicles frequently or have short commutes.

One of the main advantages of pay-per-mile insurance is that it offers a more personalized and fair pricing structure. Traditional auto insurance policies often charge a flat rate regardless of how much or how little a driver uses their vehicle. This can be frustrating for drivers who only use their cars occasionally or have short commutes, as they end up paying the same amount as someone who drives long distances every day. Pay-per-mile insurance takes into account the actual usage of the vehicle, allowing drivers to pay for only the miles they drive.

Another benefit of pay-per-mile insurance is that it encourages safer driving habits. Since premiums are based on the number of miles driven, drivers have an incentive to drive less in order to save money on their insurance. This can lead to fewer accidents and lower insurance claims, which can ultimately result in lower premiums for everyone. By promoting responsible driving behavior, pay-per-mile insurance not only benefits individual drivers but also contributes to overall road safety.

In addition to offering a more personalized pricing structure and promoting safer driving habits, pay-per-mile insurance can also help reduce environmental impact. By encouraging drivers to drive less, pay-per-mile insurance can help reduce carbon emissions and alleviate traffic congestion. This can have a positive impact on the environment and public health, making pay-per-mile insurance a more sustainable and eco-friendly option for drivers.

When comparing pay-per-mile insurance to traditional coverage, it’s important to consider the potential drawbacks as well. One concern that some drivers may have is the lack of predictability in monthly premiums. Since pay-per-mile insurance bases premiums on the number of miles driven, monthly payments can vary depending on driving habits. This can make budgeting for insurance expenses more challenging for some drivers, especially those who prefer the stability of fixed monthly premiums.

Another potential drawback of pay-per-mile insurance is the possibility of reaching a mileage cap. Some pay-per-mile insurance policies have a limit on the number of miles that can be driven in a given period, after which additional charges may apply. This can be a concern for drivers who frequently travel long distances or have unpredictable driving patterns. It’s important for drivers to carefully review the terms and conditions of pay-per-mile insurance policies to ensure that they align with their driving habits and needs.

Overall, pay-per-mile auto insurance offers a flexible and cost-effective alternative to traditional coverage. By basing premiums on the number of miles driven, pay-per-mile insurance provides a more personalized pricing structure, promotes safer driving habits, and helps reduce environmental impact. While there are potential drawbacks to consider, such as variability in monthly premiums and mileage caps, pay-per-mile insurance can be a valuable option for drivers looking to save money and drive responsibly.

1. https://suvwars.com/archive/613/

2. https://suvwars.com/archive/635/

3. https://suvwars.com/archive/939/

How Pay-Per-Mile Auto Insurance Rates are Calculated

- Pay-per-mile auto insurance is a relatively new concept in the insurance industry that is gaining popularity among drivers who want a more personalized and cost-effective insurance option. This type of insurance calculates premiums based on the number of miles driven, offering a more accurate representation of a driver’s risk profile. But how exactly are pay-per-mile auto insurance rates calculated?

- The first step in calculating pay-per-mile auto insurance rates is determining the base rate. This is the fixed amount that covers the basic costs of insurance, such as administrative fees and overhead expenses. The base rate is typically determined by factors such as the driver’s age, driving record, and the type of vehicle being insured.

- Once the base rate is established, the insurance company will then calculate the per-mile rate. This rate is based on the number of miles driven by the policyholder and is typically measured using a telematics device installed in the vehicle. The telematics device tracks the number of miles driven, as well as other factors such as driving behavior and location.

- In addition to the base rate and per-mile rate, pay-per-mile auto insurance rates may also take into account other factors such as the time of day the vehicle is driven and the type of roads typically traveled. For example, driving during peak traffic hours or on busy highways may result in a higher per-mile rate, as these conditions are associated with a higher risk of accidents.

Overall, pay-per-mile auto insurance rates are calculated based on a combination of factors that are unique to each individual driver. By using telematics technology to track driving habits and mileage, insurance companies are able to offer more personalized and flexible insurance options that better reflect the actual risk posed by each policyholder.

Transitioning to pay-per-mile auto insurance can be a smart choice for drivers who want to save money on their insurance premiums while still maintaining adequate coverage. By accurately tracking mileage and driving behavior, pay-per-mile insurance allows drivers to pay for insurance based on their actual usage, rather than a one-size-fits-all approach.

In conclusion, pay-per-mile auto insurance rates are calculated based on a combination of factors such as the base rate, per-mile rate, driving behavior, and location. By using telematics technology to track mileage and driving habits, insurance companies are able to offer more personalized and cost-effective insurance options for drivers. Making the switch to pay-per-mile auto insurance can be a beneficial choice for those looking to save money on their insurance premiums while still receiving adequate coverage.

Benefits of Pay-Per-Mile Auto Insurance:

1. Cost Savings: One of the main advantages of pay-per-mile insurance is the potential for cost savings. This type of insurance allows drivers to only pay for the miles they actually drive, rather than a flat rate that may not accurately reflect their usage.

2. Personalized Pricing: With traditional auto insurance, drivers are often grouped into categories based on factors such as age, gender, and location. Pay-per-mile insurance takes a more personalized approach by using individual driving behavior and mileage to determine rates.

3. Incentives for Safe Driving: Since pay-per-mile insurance tracks driving behavior, it can also provide incentives for safe driving habits such as avoiding speeding and sudden braking. This not only promotes safer roads but can also lead to additional savings on insurance premiums.

4. Easy Tracking and Management: With pay-per-mile insurance, drivers can easily track their mileage and monitor their driving behavior through a mobile app or online portal. This allows for better management of expenses and more accurate reporting to the insurance company.

5. Flexibility: For those who don’t drive often or have multiple vehicles, pay-per-mile insurance offers flexibility in coverage options. Drivers can choose to only insure the vehicle they use most frequently, saving money on cars that are rarely driven.

6. Environmental Benefits: By incentivizing lower mileage and safe driving habits, pay-per-mile insurance can also have a positive impact on the environment by reducing carbon emissions from vehicles.

7. Peace of Mind: With traditional auto insurance, drivers may feel like they are paying for coverage they don’t need. Pay-per-mile insurance offers peace of mind knowing that you are only paying for the miles you drive and can adjust your coverage accordingly.

Conclusion

Pay-per-mile auto insurance works by charging policyholders based on the number of miles they drive. This can help lower costs for low-mileage drivers and promote more sustainable driving habits. By adjusting your premium according to how many miles you drive, pay-per-mile insurance offers a personalized and fair approach to auto insurance. So next time you’re shopping for car insurance, consider the benefits of pay-per-mile and see if it’s the right option for you.